|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

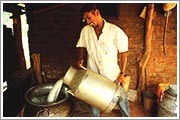

Mr. N. P. D. Eranga - Curd Producer ( Hambantota )“ Our daily profits have tripled ...”

Up to a few years ago, they used a bicycle to collect the milk and distribute the curd to their buyers. They had previously taken out a small loan from a different MFI, but were not satisfied with its interest or application process. Then the first of two micro loans from the MFI Agro Micro Finance changed the scale of their business completely. The loan of Rs.50,000 in June 2004 bought Mr. Eranga a new motorcycle. He then bought a three-wheeler with a second loan of Rs.100,000. “With the new vehicles not only could we collect more milk and deliver more curd, but could do this more often,” Mr. Eranga says happily. “Our daily profits have since tripled.” “Although the business was slow for few months after the tsunami, there has since always been height demand for my product,” he adds. “Now is the time to expand.” Mr. Eranga intends to begin producing yoghurt as well. He has completed a business training course with Agro Micro Finance’s partner Agromart and has requested a loan of Rs.150,000 to set it up. Mr. Eranga is a client of Agro Micro Finance.

Click on each picture for enlarged view. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Copyright © 2007 Agro Micro Finance. All Rights Reserved. | Solution by NeoGenius | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Mr. Eranga has been producing buffalo curd as his father did before him over 23 years. His whole family is involved in the business and his father still travels by motorcycle every day to collect 120 liters of milk from a town 30 km away from home. The milk is then boiled in huge metal cauldrons over an open fire, poured into individual clay curd pots, mixed with a culture and left to set.

Mr. Eranga has been producing buffalo curd as his father did before him over 23 years. His whole family is involved in the business and his father still travels by motorcycle every day to collect 120 liters of milk from a town 30 km away from home. The milk is then boiled in huge metal cauldrons over an open fire, poured into individual clay curd pots, mixed with a culture and left to set.